Key Takeaways

- Warren Buffett will step down as CEO of Berkshire Hathaway by the end of the year, with Greg Abel taking over.

- Under Buffett’s leadership, Berkshire achieved a 20% compounded annual gain from 1965 to 2024, significantly outperforming the S&P 500.

Share this article

Strategy Executive Chairman Michael Saylor has called Berkshire Hathaway, the renowned investment firm helmed by the legendary Warren Buffett, the Bitcoin of the 20th century.

Berkshire Hathaway is 20th Century Bitcoin.

— Michael Saylor (@saylor) May 3, 2025

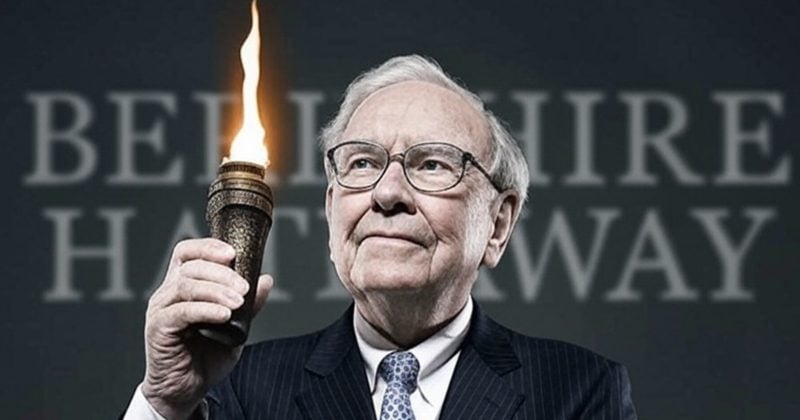

Saylor made the statement on May 3, the same day as Berkshire Hathaway’s annual shareholder meeting in Nebraska. Shortly afterwards, Buffett announced he planned to step down as CEO by year’s end, passing the torch to Vice Chairman Greg Abel.

“I think the time has arrived where Greg should become the chief executive officer of the company at year-end,” Buffett said at the close of Berkshire’s meeting.

The 94-year-old billionaire, who has led Berkshire for 60 years, said that he would not sell any of his Berkshire shares and plans to remain involved in certain matters, CNBC reported.

The move marks the end of an era for one of the most iconic figures in global finance. Buffett has turned Berkshire into a $1.1 trillion conglomerate and has become a symbol of disciplined, long-term investing.

Buffett hints at diversifying into other currencies

Also during the meeting, Buffett noted that Berkshire avoids holding assets tied to collapsing currencies. The company, he said, is open to diversifying into other currencies if the U.S. faces economic issues.

“Obviously we wouldn’t want to be owning anything that we thought was in a currency that was really going to hell,” he said. “There could be… things happen in the United States that… make us want to own a lot of other currencies.”

Other key topics raised during the meeting included trade, the U.S. economy, investing, and policy. On trade policy, Buffett stressed the value of balanced global trade and warned that trade conflicts can act as economic warfare.

Expressing deep faith in American exceptionalism, Buffett called the U.S. the best place to be born and invest, but voiced concern over the country’s growing fiscal deficit, describing it as unsustainable in the long term.

He emphasized Berkshire’s opportunistic investment approach, revealing the company had recently considered a $10 billion deal and could spend up to $100 billion under the right conditions.

Buffett argued that securities offer far better opportunities than real estate, particularly in the US, and highlighted the firm’s unique ability to invest in large-scale energy infrastructure if national policy evolves. He dismissed recent market volatility as minor and urged investors to remain unemotional.

Buffett avoids Bitcoin, but Berkshire has indirect exposure

Warren Buffett has long been a vocal critic of Bitcoin and other crypto assets, famously describing Bitcoin as “probably rat poison squared” and asserting that neither he nor Berkshire Hathaway would ever invest in cryptocurrency directly.

Despite this stance, Berkshire Hathaway’s stock has largely underperformed Bitcoin in percentage terms.

Since 2015, and especially since 2020, the gap has widened. Bitcoin has delivered gains of more than 780% since 2020, compared to approximately 150% for Berkshire over the same period.

At the time of writing, Bitcoin was trading above $96,800, down slightly over the past 24 hours, per CoinGecko.

While Buffett maintains that Bitcoin lacks intrinsic value, Berkshire has nevertheless gained indirect exposure to the digital asset space through its portfolio companies.

Notably, Berkshire holds a sizable stake in Bank of America, which has invested in multiple spot Bitcoin ETFs, including BlackRock’s iShares Bitcoin Trust (IBIT), according to filings tracked by Fintel.

The conglomerate has also invested over $1 billion in Nu Holdings, a Brazilian digital bank that operates a crypto platform and offers various crypto services, thus deepening its exposure to the sector.

Plus, Berkshire holds shares in Jefferies Financial Group, a firm that not only owns a stake in IBIT but also actively promotes Bitcoin as a hedge against inflation.

Share this article