Moving Averages serve as widely embraced technical tools in cryptocurrency trading, valued highly for their simplicity and efficacy. They furnish high-quality signals, inviting experimentation with various combinations to enhance efficiency. Among these strategies, the golden cross emerges as a pivotal pattern deserving thorough exploration. This phenomenon, indicative of trend shifts or continuations in market dynamics, encapsulates the essence of strategic cryptocurrency price action trading. Delving into its intricacies illuminates pathways for informed decision-making and amplifies the potential for successful investment outcomes.

1. What’s a Moving Average in Crypto Trading

Any discussion about ‘Golden Cross’ should start from exploring a root question: what is a moving average.

A Moving Average in Crypto Trading is like a smooth line that tracks the average price of a cryptocurrency over a specific period, such as 10 days or 50 days. It helps crypto traders see the overall trend by reducing noise from daily price fluctuations. Traders use it to identify potential buying or selling opportunities when the current price crosses above or below the moving average.

2. Golden Cross: What You Should Know

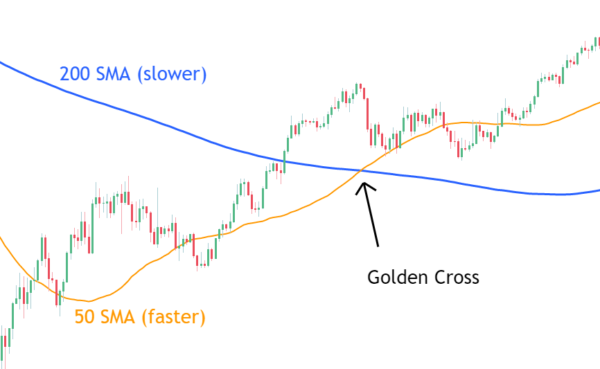

A golden cross is a term used in crypto trading when a shorter-term moving average, like the 30-day moving average, rises above a longer-term one, such as the 200-day averages.

It is seen as a positive sign because it suggests that recent price trends are gaining strength over the longer-term trends. This crossing indicates a potential upward momentum in prices, often interpreted as a bullish signal by traders.

2.1. Choosing b/w EMA and SMA for Cross Signals

When deciding between EMA and SMA for cross signals, consider their distinct characteristics. SMA gives equal weight to all data points, while EMA emphasises recent prices more. EMA reacts faster to price changes, making it beneficial for timely signals. However, both offer valuable insights, and the choice depends on individual preference and trading strategy.

2.2. Selecting the Right Timeframe for Signals

Select timeframes based on your cryptocurrency trading goals. For long-term investors, daily charts with 200-day and 50-day MAs are common. Crypto traders can adjust MA periods for shorter timeframes like hourly or 4-hour charts, or even minute charts for quick trades. Altering MA periods like 100 and 20 or 50 and 10 offers flexibility.

3. The Simplest Strategy to Trade using Golden Cross: A Step-By-Step Guide

Here is the step-by-step guide of the simplest strategy to trade using the Golden Cross signal.

Decide on the timeframe you want to analyse. Daily charts are commonly used, but you can adjust according to your trading style.

Choose the moving averages you want to use. The 50-day and 200-day simple moving averages are common choices, but you can adjust based on your preferences and the asset you are trading.

- Identify the Golden Cross

Watch for the short-term moving average to cross above the long-term moving average on your chosen timeframe.

Look for confirmation of the Golden Cross signal. This could include increased trading volume or other technical indicators aligning with the bullish trend.

Consider entering a long position (buy) when the Golden Cross occurs and the signal is confirmed. This suggests a potential uptrend in the price of the cryptocurrency.

- Set Stop Loss and Take Profit

Establish stop-loss and take-profit levels to manage your risk and lock in profits.

Keep an eye on the market and the performance of your trade. Adjust stop-loss and take-profit if necessary.

Decide on an exit strategy. This could be based on reaching a certain profit target, a reversal in the trend, or other factors you deem important.

4. Advanced Crypto Trading Strategies Using Golden Cross

Here are a few advanced crypto trading strategies using the golden cross signal.

Utilise two sets of moving averages (e.g., 50/200 and 20/50). When both Golden Crosses occur simultaneously, it signals a strong bullish trend. Execute a buy order when both crosses confirm, indicating a robust upward momentum.

Combine the Golden Cross with the Relative Strength Index (RSI). Look for the Golden Cross Signal along with RSI divergence, indicating potential overbought or oversold conditions. Execute trades based on the confirmation of both signals for added confirmation.

- Golden Cross with Fibonacci Retracemnt

Overlay Fibonacci retracement levels on the chart along with the Golden Cross. Use the Golden Cross as a confirmation to enter trades near key Fibonacci levels, enhancing entry precision. Execute trades when the Golden Cross aligns with a Fibonacci retracement level, indicating potential support or resistance.

- Golden Cross with Volume Analysis

Incorporate volume analysis alongside the Golden Cross. Look for increased trading volume accompanying the Golden Cross signal, indicating strong market participation and confirmation of the trend reversal. Execute trades when volume confirms the Golden Cross signal, increasing confidence in the trade setup.

5. Advantages & Disadvantages of Golden Cross

Here are the prime advantages of using the Golden Cross signal in crypto trading:

- Golden Cross predicts upticks, guiding traders to enter long positions for profit.

- Confirms ongoing uptrends, allowing traders to maximise gains by staying invested.

- Easy to understand and use; suitable for traders of all levels.

- Helps avoid downtrends, enabling better risk management and profit seizing.

Here are the prime disadvantages of using the Golden Cross signal in crypto trading:

- Golden Cross can give wrong signals, especially in volatile markets.

- It signals after a trend begins, making timing tricky.

- Best for long-term trends, not ideal for short-term ones.

- Don’t rely solely on it; combine with other analysis for better decisions.

Endnote

In conclusion, the Golden Cross stands as a valuable tool in cryptocurrency trading, indicating potential shifts in market trends. While offering simplicity and ease of use, it necessitates careful consideration alongside other technical indicators due to its potential for false signals, particularly in volatile markets. Despite its effectiveness in identifying long-term trends and facilitating informed trading decisions, it is essential to combine it with additional analysis for optimal outcomes. By understanding its nuances and integrating it into a comprehensive trading strategy, investors can leverage the Golden Cross to navigate the dynamic landscape of cryptocurrency markets with greater confidence and precision.

Disclaimer and Risk Warning

The information provided in this content by Coinpedia Academy is for general knowledge and educational purpose only. It is not financial, professional or legal advice, and does not endorse any specific product or service. The organization is not responsible for any losses you may experience. And, Creators own the copyright for images and videos used. If you find any of the contents published inappropriate, please feel free to inform us.