Have you been wondering which blockchains are dominating the scene today?

Imagine a treasure map leading you to hidden riches in the world of blockchain technology. That’s exactly what this analysis provides! We’ll crack the code using metrics like Total Value Locked (TVL) and user growth, revealing the blockchains that are thriving this month.

But wait, there’s more! We won’t just tell you which blockchains are on top. We’ll delve deeper, exploring their economic activity, development pace, market stability, and user adoption. By the end, you’ll have a clear picture of the current blockchain landscape and which platforms are poised for explosive growth.

Dive into this Coinpedia report now!

1. Blockchain Performance: A General Analysis

A primary analysis of the performance of a blockchain for a particular month can be done using Total Value Locked.

The total Value Locked in a blockchain’s decentralized finance ecosystem reflects the aggregate value of assets locked in smart contracts. A rising TVL indicates adoption, economic activity, and user trust, suggesting a positive month of robust DeFi participation, enhancing the overall performance of the blockchain.

1.1. Blockchain Performance Analysis Using TVL and Dominance

Here are the top ten blockchains based on the overall TVL and Dominance data:

| No. | Blockchain | TVL | Dominance |

| 1 | Ethereum | $52.236b | 56.7% |

| 2 | Tron | $9.854b | 10.7% |

| 3 | BSC | $5.709b | 6.2% |

| 4 | Solana | $4.114b | 4.47% |

| 5 | Arbitrum | $3.407b | 3.7% |

| 6 | Bitcoin | $2.729b | 2.96% |

| 7 | Avalanche | $1.196b | 1.3% |

| 8 | Polygon | $1.065b | 1.15% |

| 9 | Blast | $1.043b | 1.13% |

| 10 | Optimism | $0.97783b | 1.06% |

| Others | 10.62% |

Total Value Locked and dominance are crucial metrics for assessing blockchain performance. Ethereum leads with $52.236 billion TVL, capturing 56.7% dominance. This indicates Ethereum’s strong network effect and widespread adoption. Tron follows with $9.854 billion TVL (10.7% dominance), showcasing its significant presence in the blockchain space. Binance Smart Chain (BSC) holds $5.709 billion TVL (6.2% dominance), reflecting its growing popularity among developers and users.

Solana, with $4.114 billion TVL (4.47% dominance), demonstrates its emergence as a competitive blockchain platform. Other contenders like Arbitrum, Bitcoin, Avalanche, Polygon, Blast and Optimism also contribute to the ecosystem with varying degrees of TVL and dominance. This analysis highlights Etheruem’s strong dominance, but also signals the increasing diversity and competition within the blockchain landscape.

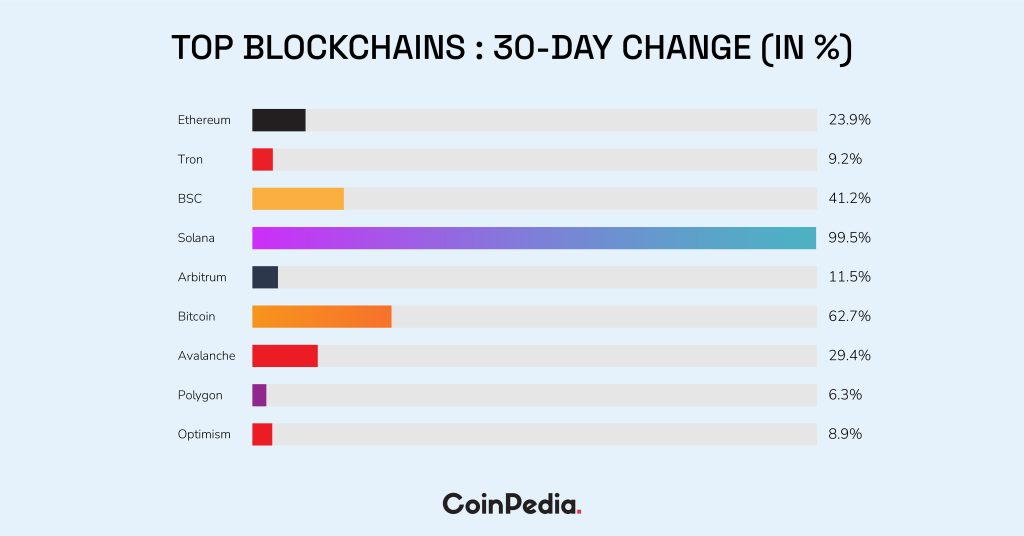

1.1.1. Analysing Top Blockchains Using 30-Day TVL Movement

Let’s analyse the top blockchains with highest TVLs using the 1-month change data, to know how much movement the top chains have witnessed in the last 30 days.

| No. | Blockchain | 30-Day Change (in %) |

| 1 | Ethereum | +23.94% |

| 2 | Tron | +9.20% |

| 3 | BSC | +41.21% |

| 4 | Solana | +99.55% |

| 5 | Arbitrum | +11.55% |

| 6 | Bitcoin | +62.66% |

| 7 | Avalanche | +29.42% |

| 8 | Polygon | +6.27% |

| 9 | Blast | N/A |

| 10 | Optimism | +8.93% |

Over the past 30 days, among the top ten blockchains with highest year to date TVL, Solana exhibited the highest growth rate in Total Value Locked at +99.55%, followed by Bitcoin with +65.66% and Binance Smart Chain (BSC) at +41.21%. This indicates a surge in user activity and investment across these platforms.

Ethereum, although experiencing a positive 30-day change of +23.94%, lags behind in growth compared to its prime competitors. Other Layer 1 solutions like Avalanche and Arbitrum also displayed notable increase in TVL, suggesting growing interest in alternative blockchain ecosystems. However, networks such as Tron, Optimism, and Polygon saw relatively smaller gains, indicating less robust growth or possibly increased competition.

Also Read : Top Stablecoins Report: March Market Analysis & Key Trends in Focus

1.2. Blockchain Monthly Performance Analysis Using 30-Day TVL Movement

Let’s see how things will appear when we do the performance analysis solely based on the 30-day TVL movement data.

| No. | Blockchain | 30-Day Change (in %) |

| 1 | StarkNet | 387.4% |

| 2 | Solana | 103.1% |

| 3 | Base | 77.3% |

| 4 | Aptos | 60.8% |

| 5 | Sei Network | 56.1% |

| 6 | Aurora | 48.8% |

| 7 | Boba Network | 46.7% |

| 8 | ZetaChain | 45.4% |

| 9 | BNB Smart Chain | 41.5% |

| 10 | Scroll | 40.4% |

The 30-day Total Value Locked movement provides insights into blockchain performance. StarkNet leads with an impressive 387.4% surge, indicating heightened activity and capital influx. Solana follows suit with a substantial 103.1% increase, suggesting growing user adoption and network utilisation.

Base and Aptos show significant growth at 77.3% and 60.8%, respectively, reflecting positive market sentiment and project developments. Sei Network and Aurora exhibit moderate gains, indicating steady progress. Boba Network, ZetaChain, BNB Smart Chain and Scroll also show promising increases, showcasing resilience and utility.

2. Blockchain Comparative Analysis: How Top Blockchains Performed This Month

By focusing on four aspects, you can gain insights into the economic strength, development activity, market stability, and adoption potential of each blockchain.

2.1. Blockchain Analysis: Total Value Locked and Economic Activity

Let’s assess the economic activity within each blockchain’s ecosystem. A higher TVL, transaction volume, and revenue may indicate a more vibrant and utilised blockchain.

| Blockchains | Revenue | Fees | Volume | TVL |

| Ethereum | $8400k | $9.37m | $2409m | $52.236b |

| Tron | $1740k | $1.74m | $36m | $9.854b |

| BSC | $100.27k | $1m | $1337m | $5.709b |

| Solana | $2470k | $4.95m | $3450m | $4.114b |

| Arbitrum | $123.2k | $0.127m | $731.33m | $3.407b |

| Bitcoin | N/A | $2.89m | $0.6006m | $2.729b |

| Avalanche | $142.49k | $0.142m | $810.94m | $1.196b |

| Polygon | $14.8k | $0.0562m | $158.09m | $1.065b |

| Blast | N/A | N/A | $9.35m | $1.043b |

| Optimism | $83.33k | $0.844m | $48.77m | $0.97783b |

Blockchain analysis focusing on Total Value Locked reveals Ethereum dominating with $52.236 billion, showcasing its robust ecosystem and widespread usage. Tron and Binance Smart Chain follow with $9.854 billion and $5.709 billion, respectively, reflecting significant economic activity and user engagement. Solana’s $4.114 billion TVL underscores its emergence as a prominent blockchain platform. Arbitrum and Bitcoin also demonstrate substantial economic activity.

Blockchain Economic Activity Analysis focusing on Volume reveals Solana leading with $3450 million, indicating high transactional throughput and network usage. Ethereum follows closely with $2409 million, showcasing its established position in the blockchain space. Binance Smart Chain (BSC) and Avalanche demonstrate substantial volume, reflecting active user participation and network activity. Bitcoin’s relatively low volume suggests a focus on value storage rather than transactional use.

Blockchain Economic Activity Analysis focusing on Fees highlights Ethereum as the leader with $9.37 million, reflecting its high network usage and demand for transactions. Solana follows with $4.95 million, indicating significant activity and value transfer. Bitcoin and Tron also demonstrate notable fee revenues, reflecting transnational demand. Lower fee revenues from Optimism, Avalanche, Arbitrum and Polygon suggest lower transaction volumes or lower fees structures.

Blockchain Economic Activity Analysis focusing on Revenue reveals Ethereum as the leader with $8.4 million, indicative of its significant ecosystem value and transactional activity. Solana follows with $2.47 million, reflecting growing network utility. Tron demonstrates substantial revenue, showcasing active network usage. Avalanche and Arbitrum exhibit moderate revenue, while Binance Smart Chain and Optimism show lower revenue, suggesting varying levels of network activity and monetisation strategies.

Overall Economic Activity Analysis across TVL, Volume, Fees and Revenue metrics showcases Etheruem as the dominant force, boasting a TVL of $52.236 billion, $2409 million in Volume, $9.37 million in Fees, and $8.4 million in Revenue. Solana emerges as a strong contender with $3450 million in Volume, $4.95 million in Fees, and $2.47 million in Revenue. Tron and Binance Smart Chain follow suit, reflecting notable economic engagement. Etheruem’s consistent leadership across these key indicators cements its position in the blockchain landscape.

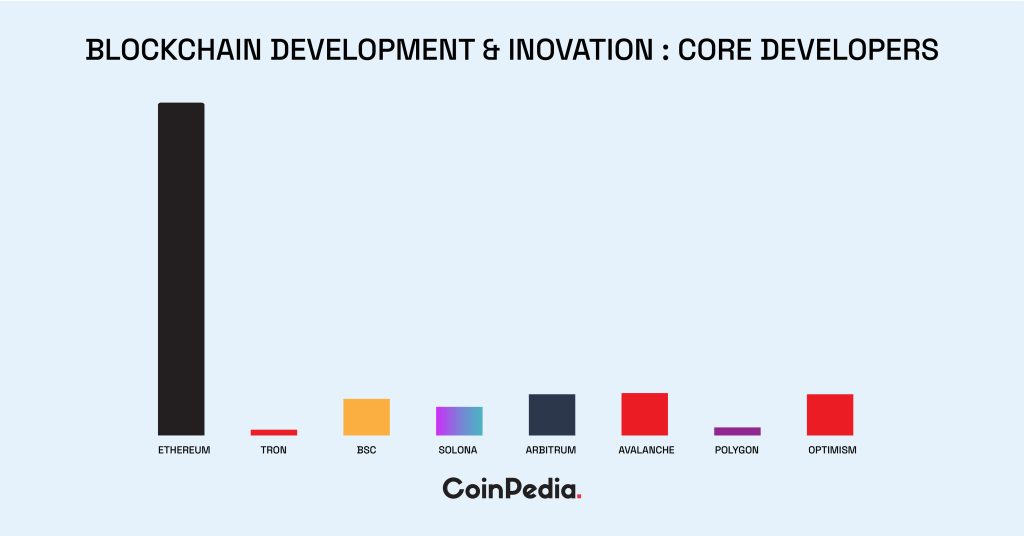

2.2. Blockchain Analysis: Development and Innovation

Let’s evaluate the development activity and innovation within each blockchain. A blockchain with a strong development community, active core developers, and a higher number of commits may suggest ongoing improvement and evolution.

| Blockchains | Commits | Core Developers |

| Ethereum | 8690 | 291 |

| Tron | 36 | 5 |

| BSC | 374 | 32 |

| Solana | 598 | 25 |

| Arbitrum | 1140 | 36 |

| Bitcoin | N/A | N/A |

| Avalanche | 1800 | 37 |

| Polygon | 133 | 7 |

| Blast | N/A | N/A |

| Optimism | 1400 | 36 |

Blockchain Development and Innovation Analysis focusing on Core Developers reveals Ethereum as the frontrunner with 291 core developers, indicating a robust and continuously evolving ecosystem, Avalanche follows with 37 developers, showcasing a growing focus on innovation. Optimism and Arbitrum both have 36 developers each, indicating substantial efforts towards scaling solutions.

BSC boasts 32 developers, reflecting its commitment to ecosystem expansion. Solana’s 25 developers signify dedicated work on enhancing the platform’s capabilities. Polygon and Tron, with 7 and 5 developers, highlight ongoing development efforts but at a comparatively smaller scale.

Blockchain Development and Innovation Analysis focusing on Commits highlights Ethereum as the most active platform with 8690 commits, indicative of its vibrant development community and continuous improvement efforts. Avalanche follows with 1800 commits, demonstrating a strong commitment to advancing its technology.

Optimism and Arbitrum show significant activity with 1400 and 1140 commits respectively, emphasising their dedication to scalability solutions. Solana’s 598 commits reflect ongoing enhancement to its network. BSC, Polygon, and Tron exhibit fewer commits, with 374, 133, 36 respectively, suggesting comparatively lesser development activity.

Overall Blockchain Development and Innovation Analysis integrates Core Developers and commit data. Ethereum emerges as the leader with 291 core developers and 8690 commits, showcasing a vibrant ecosystem and continuous improvement efforts. Avalanche follows closely with 37 developers and 1800 commits, highlighting a growing focus on innovation and technology advancement.

Optimism and Arbitrum demonstrate significant commitment to scalability solutions with 36 developers each and 1400, 1140 commits respectively. Solana’s 25 developers contribute to 589 commits, indicating dedicated work on enhancing the platform’s capabilities. This analysis underscores Ethereum’s prominent position.

You: Must-Know February 2024 NFT Trends & Projects

2.3. Blockchain Analysis: Market Performance and Stability

Let’s analyse the market performance and stability of each blockchain’s native cryptocurrency. The prevalence and usage of stablecoins within the ecosystem can measure stability and potential as a medium of exchange.

| Blockchains | Price | Stablecoins Market Cap |

| Ethereum | $3530 | $77.252b |

| Tron | $0.1 | $53.094b |

| BSC | $554.2 | $4.768b |

| Solana | $196.3 | $2.751b |

| Arbitrum | $3530 | $2.582b |

| Bitcoin | $67710 | N/A |

| Avalanche | $60.4 | $22.814b |

| Polygon | $1 | $1.469b |

| Blast | N/A | N/A |

| Optimism | $3530 | $0.7064b |

Blockchain Market Performance and Stability Analysis reveals Ethereum as the top performer with a price of $3530 and a stablecoin market cap index of $77.252 billion, indicating its robust ecosystem and stability. Tron follows with a lower price of $0.1 but a substantial stablecoin market cap index of $53.094 billion, showcasing its market influence despite a lower price.

Avalanche shows a lower price of $60.4 but a significant stablecoin market cap index of $22.814 billion, indicating market strength. Binance Smart Chain demonstrates a higher price of $554.2 and a moderate stablecoin market cap index of $4.768 billion, indicating a strong market presence but with lesser stability.

Solana and Arbitrum exhibit moderate prices of $196.3 and $3530 respectively, with stablecoin market cap indices of $2.751 billion and $2.582 billion, reflecting their growing market stability. Polygon and Optimism exhibit mixed price trends with stablecoin market cap indices of $1.469 billion and $0.7064 billion respectively, suggesting emerging stability within their ecosystem.

2.4. Blockchain Analysis: Adoption and User Interest

Let’s examine the level of adoption and user interest by looking at inflows, coin price and market capitalisation. A blockchain with increasing user interest and growing market capitalisation may indicate a higher level of adoption.

| Blockchains | Token Price | Token Market Cap | Net Inflows |

| Ethereum | $3530 | $423.583b | $17.82m |

| Tron | $0.1 | $10.892b | N/A |

| BSC | $554.2 | N/A | -$0.31m |

| Solana | $196.3 | $87.207b | -$0.56m |

| Arbitrum | $1.6 | $4.328b | -$19.61m |

| Bitcoin | $67710 | $1332b | N/A |

| Avalanche | $60.4 | $22.814b | -$5.56m |

| Polygon | $1 | $9.57b | $1.02m |

| Blast | N/A | N/.A | N/A |

| Optimism | $3.3 | $3.325b | -$0.86m |

Blockchain Adoption and User Interest Analysis focusing on Net Inflows reveals Ethereum as the leader with a positive net inflow of $17.82 million, showcasing sustained user interest and adoption. Polygon follows with a smaller positive inflow of $1.02 million.

Arbitrum, despite its negative net inflow of -$19.61 million, still reflects substantial user engagement. Avalanche and Optimism show negative net inflow of -5.56 million and -$0.86 million respectively, indicating some user disengagement. Solana and Binance Smart chain exhibit marginal negative net inflows, suggesting relatively stable user activity.

Blockchain Adoption and User Interest Analysis focusing on Token Price and Market Cap reveals Bitcoin as the leader with a token price of $67.71k and a market cap of $1.332 trillion, showcasing immense user interest and adoption.

Ethereum follows with a lower token price of $3.53k but a significant market cap of $423.583 billion, indicating a strong user base and ecosystem. Solana exhibits a higher token price of $196.3 and a substantial market cap of $87.207 billion, reflecting growing adoption. Avalanche, Tron, and Polygon show lower token prices but notable market caps. Arbitrum and Optimism exhibit lower token prices and market caps.

Overall Blockchain Adoption and User Interest Analysis combines Net Inflows with Token Price and Market Cap data. Ethereum leads with positive net inflows, a lower token price, and a significant market cap, showcasing sustained user interest and adoption. Polygon follows with positive net inflows, indicating growing interest despite a lower token price and market cap.

Avalanche and Optimism exhibit negative net inflows but notable market caps, suggesting some user disengagement. Solana shows marginal negative net inflows despite a higher token price and substantial market cap, reflecting stable user activity. Bitcoin remains a leader with its high token price and immense market cap, indicating strong user interest and adoption.

Endnote

In conclusion, this monthly report serves as a compass for navigating the ever-changing terrain of blockchain technology. By examining key metrics such as TVL, dominance and 30-day TVL movement, we gain a deeper understanding of the performance dynamics within the blockchain ecosystem.

Furthermore, our comparative analysis sheds light on the nuanced difference between top blockchains, offering valuable insights into economic activity, development, market performance, and adoption trends. As blockchain continues to redefine industries and shape the future of finance and technology, may this report serve as a valuable resource for stakeholders and enthusiasts alike.