CryptoQuant analysts have revealed that the cryptocurrency market risk remains high despite the decline in Bitcoin prices. The on-chain data analysts also noted that only 24% of BTC’s circulating supply is in an unrealized loss.

The analyst noted that the unrealized loss depicted historical early-stage corrections rather than continued decline. He also said that the lack of widespread loss realization suggests the market has not yet entered a re-accumulation phase.

Market risk remains elevated despite Bitcoin price drop

Market Risk Remains Elevated Despite BTC Price Decline

“Currently, only 24% of the circulating supply is in an unrealized loss, a relatively low level historically associated with early-stage corrections rather than full-scale capitulation.” – By @Crazzyblockk pic.twitter.com/OQZTd1kP79

— CryptoQuant.com (@cryptoquant_com) April 15, 2025

CryptoQuant analysts have revealed that the cryptocurrency market risk remains high despite the decline in Bitcoin prices. The on-chain data analyst also noted that only 24% of BTC’s circulating supply is in unrealized loss, a relatively low level historically associated with early-stage corrections rather than full-scale capitulation.

Crazzyblockk also highlighted that the unrealized loss component is clustered within the historical bottom zone. He believes it indicates that downside absorption is primarily occurring among long-term holders. The analyst also argued that the behavior preceded prolonged consolidation or further volatility rather than immediate recovery.

“The lack of widespread loss realization suggests that the market has not yet entered a high-conviction re-accumulation phase. In such an environment, reactive trading could lead to suboptimal outcomes.”

–Crazzyblockk, CryptoQuant analyst.

The on-chain data analyst also suggested the need for investors to stay sidelined and observe the market structure evolve due to the current supply dynamics and low unrealized losses. He also urges market participants to allow price action and investor behavior to confirm directional bias before making allocation decisions.

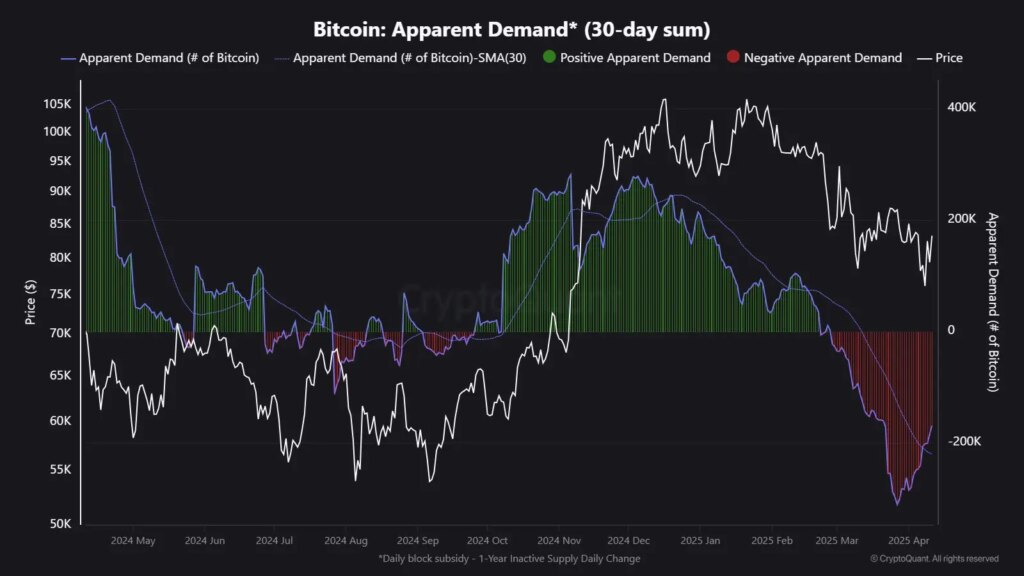

CryptoQuant analyst Kripto Mevsimi revealed that on-chain data shows the current recovery in BTC may be linked to improving demand indicators. He also suggested that the broader market structure still needs to confirm whether the current bounce reflects a sustainable rally or is merely a temporary pause in the ongoing correction.

Mevsimi also drew attention to BTC’s Apparent Demand metric, specifically the 30-day sum, which has started to rebound from negative territory. He said the trend is being observed as a potential sign of changing market dynamics.

The analyst also warned against assuming the trend as the start of a new bullish cycle, drawing parallels to Bitcoin’s behavior during the latter part of the 2021 cycle. He noted that demand remained suppressed for an extended timeframe during that period, even as prices recovered. Mevsimi noted that the market experienced a genuine structural shift only after a long consolidation phase.

Short-term selling pressure declines on Binance

CryptoQuant analyst Darkfost reported that inflows of BTC from short-term holders (STHs) to Binance have been steadily plummeting. He argued it suggests a decline in immediate selling pressure.

Darkfost also noted that on-chain data indicate that average realized prices for STHs currently stand around $92,800, meaning that many recent sellers have exited at a loss. The analyst highlighted that inflows from STHs dropped from roughly 17,000 BTC in November to around 9,000 Bitcoin more recently. He argued that the downtrend in selling could provide some support for the digital asset’s current price levels.

The analyst still emphasized the need for continued monitoring of the market to determine if the reduction in selling pressure continues. Darkfost believes the easing of short-term holder activity could reduce overhead resistance and contribute to market stability.

According to crypto analyst BTCEarth, Bitcoin could be setting the stage for a major reversal after rising above the $85K mark. BTCEarth referred to a key support zone that continues to hold, showing the possibility of a bottom formation.

The analyst noted that the price action has “respected the long-standing blue support line,” which was established around the “Trump rally breakout.” He also argued that the current structure suggested a “possible bottom formation near this zone, supported by volume and historical price behavior.”

BTCEarth maintained that the repeated validation of the support suggests that the digital currency is building a strong foundation. He believes a bullish reversal is imminent if the structure holds, especially as momentum and historical price behavior support a potential break from the area.

Cryptopolitan Academy: Coming Soon – A New Way to Earn Passive Income with DeFi in 2025. Learn More