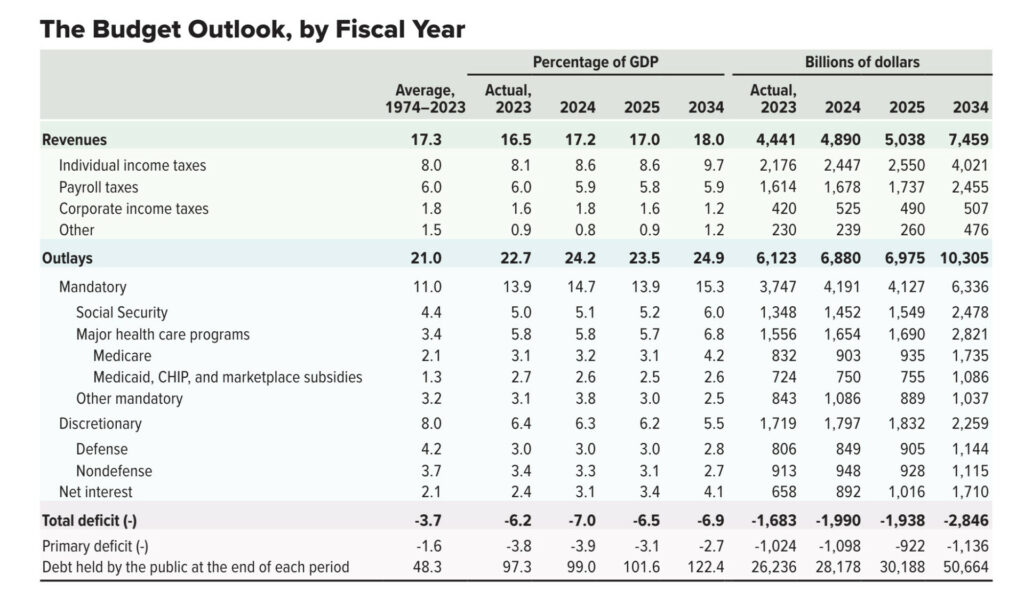

America’s ever-growing debt problem is a ticking time bomb that could either push the crypto market to record-breaking heights or bring it crashing down. The Congressional Budget Office (CBO) recently projected that aid packages for Ukraine and Israel, combined with other factors like student loan forgiveness, will push the US deficit to a staggering $1.9 trillion this fiscal year.

This ballooning deficit, coupled with a shift towards short-term financing, has some MAJOR implications for the US economy, money markets, and the fight against inflation.

Boosting Crypto

One key way America’s debt problem would benefit the crypto market is through its impact on inflation. As the debt grows, there’s a risk the government will resort to printing more money to service this debt, leading to higher inflation.

Due to their limited supply, cryptocurrencies are viewed as a hedge against inflation. If inflation rises, more investors might flock to crypto as a safe haven.

Another factor is the potential loss of confidence in the fiat currency. As the US debt climbs, faith in the dollar could wane, prompting people to seek alternatives.

With their decentralized nature and through stablecoins, cryptocurrencies will become more attractive as both a store of value and a medium of exchange. This would bring a significant increase in crypto adoption and investment.

Global economic instability is another concern tied to rising debt levels. When debt reaches unsustainable levels, it will lead to geopolitical and economic uncertainty.

In such scenarios, investors often seek out safe havens. Crypto, not being tied to any single nation’s economy, would benefit from this. Institutional investment is another aspect that could also see a boost.

As traditional financial markets become riskier due to the US debt situation, more institutional investors will be tempted to diversify their portfolios by including crypto assets.

This trend has already begun, with several major financial institutions knee-deep in crypto. If the debt situation worsens, this trickle could become a flood, boosting the crypto market in ways we’ve never seen.

Breaking Crypto

However, America’s debt problem could also spell disaster for the crypto market. One major risk is a regulatory backlash. As governments struggle to manage rising debt and economic instability, they will consider placing stricter cryptocurrency regulations to control capital flows and maintain economic stability.

That would stifle innovation, reduce market liquidity, and create major barriers for new entrants. Market volatility is another concern. The uncertainty surrounding the US debt situation would increase volatility in all financial markets. Cryptocurrencies, known for their wild price swings, might become even more unpredictable.

This heightened volatility will reduce overall market participation and lead to a crash. In the middle of a liquidity crunch, investors will be forced to sell off their crypto holdings to cover losses in other areas or to access cash. The mass sell-off we would see if that happens would be unprecedented.

The impact on the tech sector is another factor to consider. The crypto industry is closely linked to the tech sector and the broader US stock market. If economic conditions worsen due to high debt levels, investment in tech and stocks will dwindle.

This reduced investment will indirectly affect the growth and development of crypto projects, slowing down the entire industry. Adding to these challenges is the size of the Treasury market, which has quintupled since the 2008 financial crisis.

As the deficit rises, the US Treasury finds it increasingly hard to finance through long-term debt without causing an uncomfortable rise in borrowing costs. The change to short-term debt will disrupt money markets and complicate the Federal Reserve’s efforts to control inflation.

Money market funds, which invest heavily in short-dated debt, remain big investors in Treasury bills. However, with the Federal Reserve pulling back from the market, the balance between buyers and sellers of US bonds is fundamentally changing.

The question of who will buy all the debt on offer has plagued economists and analysts for months. If demand for US debt decreases, borrowing costs could rise sharply, further straining the economy and making the debt problem even worse.

This will lead to even more economic instability, driving investors to seek refuge in cryptocurrencies. However, if governments choose to respond vindictively, the market WILL break.

But they probably won’t.

Right?

Jai Hamid